AUTUMN BUDGET - 30 OCTOBER 2024

October 30, 2024

The Budget of huge change. Rachel Reeves delivered her first Budget for the new-ish Labour Government, notable as the first by a female Chancellor in the UK’s history.Prior to the Budget there had been huge speculation about the content. Tax rises were expected, and the Ch...

BUDGET 2024

March 7, 2024

Key points

The key points are covered below. You can also view or download our more detailed booklet by clicking the link above:OverviewMost tax rates and allowances were announced in advance at the Autumn Statement, and the significant new proposals were all predicted – there were n...

Autumn Statement 2023

November 23, 2023

Mind your headroom

In the weeks leading up to the Autumn Statement, the press was full of speculation about tax cuts. This was a surprise, just over a year after the tax cuts announced by Kwasi Kwarteng were judged imprudent by the international markets, contributing to a fall in the value of ...

Autumn Statement 17 November 2022

November 18, 2022

This was the third fiscal statement this year and the third different chancellor to deliver it. We have had four Chancellors in the UK this year, but Chancellor three of the year, Nadeem Zahawi, didn’t get the opportunity to deliver a fiscal statement at all.

Jeremy Hunt�...

Winter Economy Plan

September 24, 2020

Rishi Sunak announced his Winter Recovery Plan on 24 September 2020.

This package of measures is designed to limit the impact of the current pandemic on the UK economy.

Below we have set out the various measures. Do not hesitate to contact us if you need help with ...

Spring Budget 2020

March 12, 2020

Spring Budget 2020

“Getting it done” was the constant refrain of Chancellor Rishi Sunak during his first Budget, delivered on 11 March 2020. An ironic phrase given this budget was originally scheduled for November 2019. The original Budget being delayed by the election. Of course, that ori...

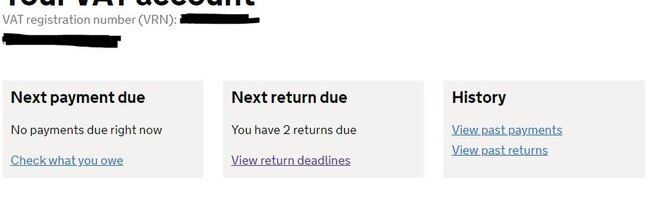

VAT payment deferment

March 25, 2020

The chancellor recently announced fantastic support to VAT registered business with the deferment of paying VAT. To be clear this does not not change the charging of VAT on sales invoices, the claiming on purchases or the filing of the VAT return. This scheme has no impact o...

The Autumn Budget 2017

November 24, 2017

Philip Hammond gave his 2nd Budget as Chancellor on 22 November 2017. The Government’s original targets have been shredded and it is expected that the books will now not come in to Annual Balance until the mid 2020’s.

The Chancellor did announce some big spending plans s...

A lot of clients and small businesses have taken advantage of the VAT Flat Rate Scheme....

TAGS

taxBudgetcorporation taxPersonal taxvatNational InsuranceSDLTchancellorHMRCpropertyCompany taxsmall businessesAutumn statementemploymentPayrollSelf assessmentFurloughed workersholiday homeIR35residential propertystamp dutytax liabilitiesautumn budgetbankingBenefit in KindCarsCJRSCompany lawConfirmation Statementsflat rate schemegrantsinheritance taxlimited cost traderMaking Tax Digitalmortgage interest reliefMTDNational Minimum WageOverseaspension contributionsReceipt BankRegistered OfficeTrainingvat flat rate schemeXero